EMPLOYER SOCIAL CHARGES

We maintain a list of mandatory EMPLOYER social charges. We re issue it every 6 months. If you want to receive an update please contact us on info@lecheminantinternational.com

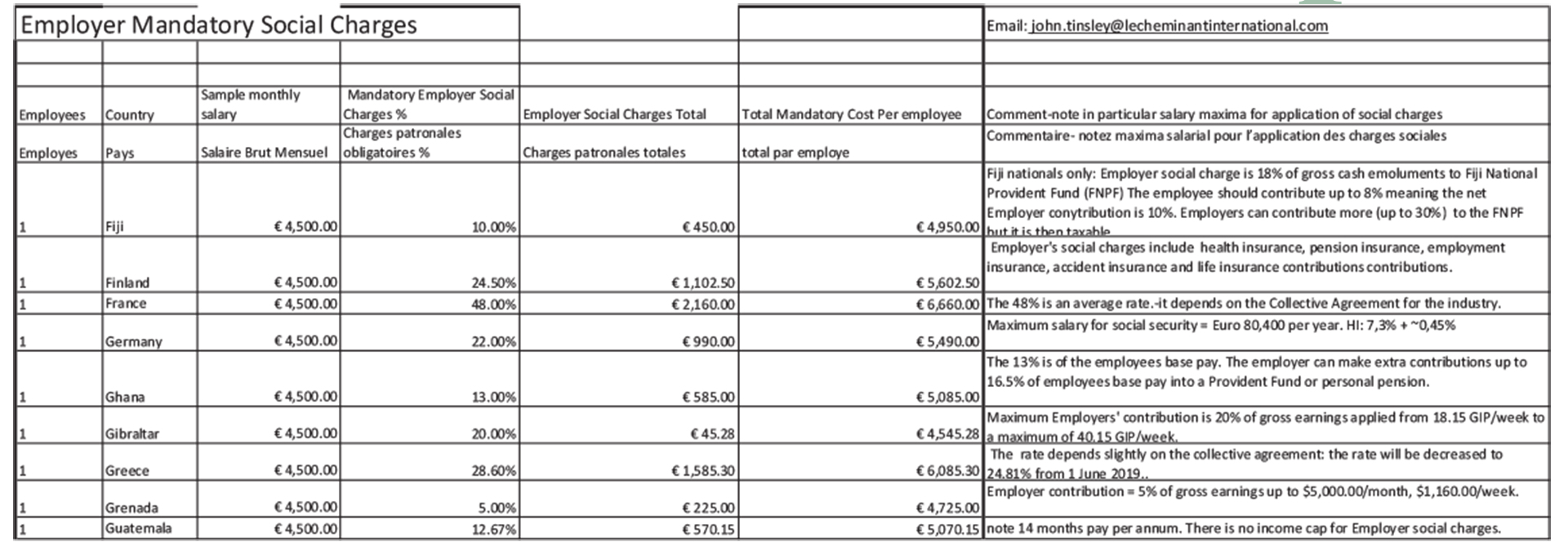

We do not guarantee that it is 101% perfectly up to date but for most decisions about costs, and budgeting it is pretty useful.

Many social charges have maximum salary limits and Le Cheminant International only invoice clients with the social charges genuinely incurred. Many of our competitors charge a flat % of social charges forgetting the salary limits.

Major changes :

REDUCTIONS In 2018 in Lithuania the employer social charges were 31.18% of gross remuneration: they are now 3.03% of gross remuneration. In 2017 the employer social charges in Romania were 23.15% of gross remuneration. Now the figure is 2.25%.

INCREASES

In 2015 the level of social charges in Mexico were 31.43% of gross remuneration. This has risen to 51.15% . The % has always been “capped” at 25 times the minimum wage.

See below a snapshot of 2023 social charges, shown so you can get an idea of how useful this can be. To see the full spreadsheet please click on the download button or picture right.

Contact us:

UK +44 (0)7958 173708

Swiss +41 (0)79 285 9713

Write us: john.tinsley@lecheminantinternational.com

EMPLOYEE SOCIAL CHARGES SNAPSHOT