Lithuania

International Payroll

Global HR

Le Cheminant International has its own company in Lithuania, UAB Le Cheminant Lithuania. The company was previously named Compandben Lithuania and has been providing friendly and expert services since 2017.

HR support

The services offered are:

- Recruitment services

- Employment Contracts (usually free)

- Employment costing

- Expatriation advice and documentation

- Employee Handbooks

- Remuneration and Benefit Advice

- Social security advice and registration

- Termination advice

- Employment Services – UAB Le Cheminant Lithuania employs staff on behalf of clients, so there is no need for the client to set up a legal entity in Lithuania

- We legally employ the staff paying social security -administered through SODRA – the State Social Insurance Fund Board under the Ministry of Social Security and Labour, through “Territorial Divisions” and we will administer any private pension, health insurance or other benefits required, Taxes are remitted to the Lithuania Tax Inspectorate.

- And our employees are called Employees not consultants !

- Obviously a full payroll service backs up the employment with regular filings sent to SODRA.

- We can also lease company cars for the employees if required by our clients.

Payroll Administration

- Gross /Net calculations

- Payment of employees, social charges and taxes, to SODRA

- Social Security Administration

- Administration and payment of private health care providers, pension plans and other benefit providers. xxxxxx

- Payroll Journal, General Ledger maintenance

- Employee self service,

- Calculation and payment of taxes on cars and other BIK (Benefits in Kind) calculations,

- Employee share plan and options calculations

- Tax and social security quarterly and annual filings

Accounting and Company Secretarial support

A full administration service including

-

-

- bookkeeping,

- digital tax services,

- tax advice (individual and corporate)

- benefits consulting.

- Social Security contribution table

-

Employment Services

- UAB Le Cheminant Lithuania employs staff on behalf of clients, so there is no need for the client to set up a legal entity in Lithuania

- We legally employ the staff paying social security -administered through SODRA – the State Social Insurance Fund Board under the Ministry of Social Security and Labour, through “Territorial Divisions” and we will administer any private pension, health insurance or other benefits required, Taxes are remitted to the Lithuania Tax Inspectorate.

- And our employees are called Employees not consultants !

- Obviously a full payroll service backs up the employment with regular filings sent to SODRA.

- We can also lease company cars for the employees if required by our clients.

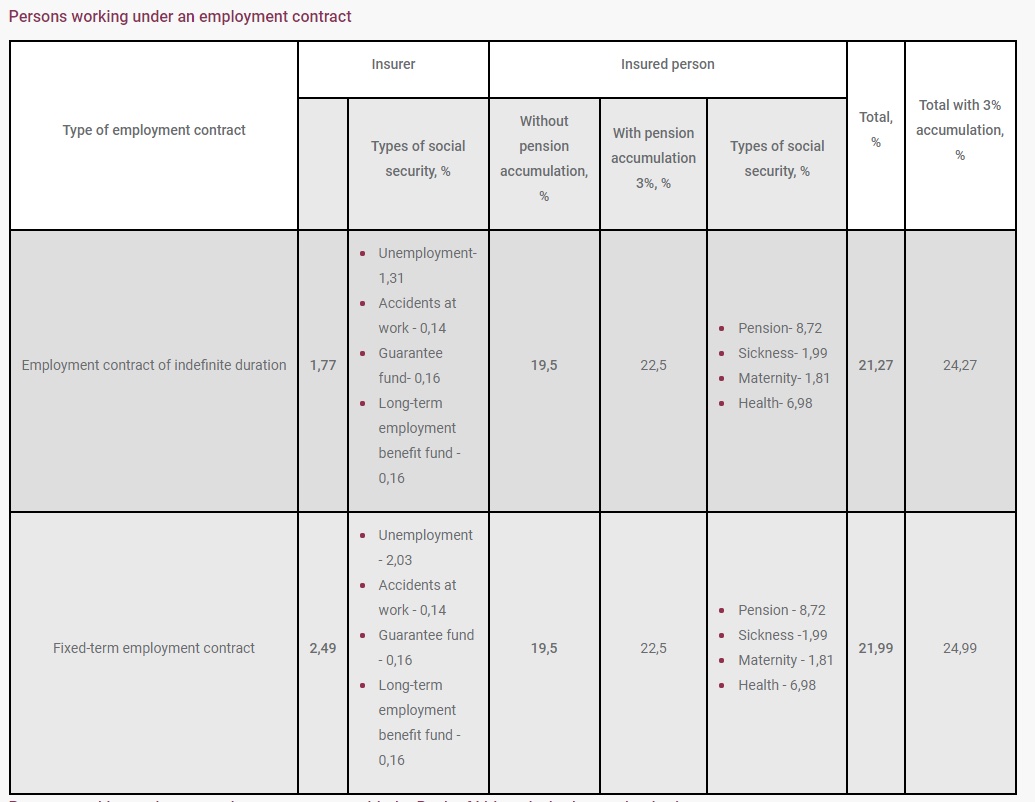

Employer Social Security Payments

Lithuania Employers’ mandatory social charge burden used to be one of the highest in the world at 31.18% of gross remuneration, but was lowered in 2018 to 1.77%. It is very slightly higher for fixed term contracts 2.49% but remains one of the lowest in the world, comparing to …say …46% in France, 31% in Sweden, and 32% in Belgium<-p>

The Employer social security payment includes

- Guarantee fund 0.16% of gross remuneration for a “Guarantee Fund” for protection of employees should a company go bankrupt,

- Long term unemployment contribution =0.16% of gross remuneration

- Workers Compensation – for accidents =0.14% and for unemployment =1,31% of gross remuneration.

EMPLOYEES in Lithuania on the other hand pay 19,5% or 22,5% (With pension accumulation 3%)of remuneration for pension, sickness, maternity and health. These costs though drop to 6.98%once a maximum of Euro 114,162 (60 times the average wage (called VDU) x 1902,7 Eur) is reached.